Table of Contents

Updates & Warnings!

Coinloan has been declared bankrupt as of 14 June 2023

Coinloan Review

Free

Coinloan is the crypto equivalent of a traditional bank: Customers can create wallets, exchange currencies, earn interest and get loans. The loans are collateralized by crypto and will automatically be liquidated when the value of the crypto drops to 90% of the loan. You can earn up to 10% on stablecoins and fiat.

Pros

- High profitability (10% / year)

- Transparant business model

- EU regulated financial institution

- Highly rated/reviewed

- Very responsive customer support

- Easy to set up

- High flexibility: Most coins accepted and high flexibility

Cons

- Dependent on crypto market conditions

- Have restricted withdrawals before to avoid a bank run

Key Features

- Yearly return of 10% on stablecoins and fiat

- Auto-compounding

- Minimum €10 deposit and €100 for accruing interest

- Withdrawals can be made via crypto, SEPA, Advcash or Swift

- Affiliate rewards: 0.1-0.2% of loan, interest and exchange amounts.

What is Coinloan and how does it work?

CoinLoan is a global financial firm and cryptocurrency loan platform. Its clients can borrow, trade, hold, and profit from digital assets.

How does Coinloan make money?

Coinloan makes money the same way traditional banks do. They get people to deposit on the platform and they use those deposits to give out loans. Just like a savings account people can earn interest on their interest account.

Most of Coinloan's revenue would therefore come from the interest they charge on loans and exchange charges.

What does Coinloan not do?

- It is not trading, it is therefore susceptible to coin price fluctuations.

- It is not Mining (Proof of Work) which requires complex calculations and consumes a lot of energy.

Is Coinloan safe?

I believe nothing in the cryptocurrency world is truly safe. The market is much more volatile than the housing, bonds or stock market. However, I believe Coinloan's business model is quite low risk because of the following reasons:

- If someone cannot repay their loan they can simply liquidate their collateral.

- If a cryptocurrency loses too much of its value loans will liquidate.

- If Coinloan cannot maintain the interest rates on their interest accounts they can lower them.

What are the risks?

- Liquidity Risk: There is the risk that Coinloan doesn't have enough liquidity (cash) to pay its investors/suppliers. This could especially be the case if there is a “bank run”, where depositors are pulling out their funds.

- (Crypto) Currency depreciation: currencies can drop in value, which causes loans to be liquidated. Liquidation would mean that Coinloan cannot earn money from that loan anymore.

Profitability (Personal Results included)

The holding of CLT increases your returns as followed.

- 125 CLT raises your Interest Account rates by 0.1%

- 375 CLT — by 0.3%

- 1,000 CLT— by 0.8%

- 1,250 CLT — by 1%

- 2,500 CLT — by 2%

I've had returns of 10% per year (APY). To get the full percentage you need to keep compounding your returns for the entire year.

Note: APY includes the compounding effect, APR does not.

How do the payouts happen?

The interest accumulates day by day be only get released once the month have ended. The returns are split up between completed/earned interest and accrued/scheduled interest. The scheduled interest gets converted into earned interest on the first day of the next month.

Final thoughts

CoinLoan is an interesting, stable, unique investment. I hope the organization is strong enough to survive difficult times in the crypto market. One of the strongest selling points is that it has a few financial licenses.

FAQ

How do you use coinloan?

I use Coinloan as part of a diversified strategy (aside stocks, ETFs, staking and real estate). I auto-compound because this maximises my returns. I'm only investing in stablecoins at this time.

Do you stake CLT (CoinLoan's coin)?

I don't stake CLT, because I think the returns are not worth the risk. From Jan 2022 to Nov 2022 the coin's value has dropped 50%. However if we assume a value of $15 per CLT, then a 1000 CLT will require 15,000 USD for an additional return of 1%.

Do I need any technical skills to use Coinloan?

No, you do not need any technical skills. I do recommend having an exchange account. If don't have a crypto exchange (e.g. Binance), don't worry they are easy to set up. I recommend transferring using USDT (or USDC) because it's a stablecoin and the value is linked to USD. This eliminates any exchange risks.

Who can sign up with Coinloan?

I believe Coinloan accepts most countries, you'll need to be able to withdraw/deposit though.

Are there any fees/costs?

No, you'll never need to pay anything.

Can I compound my returns?

Yes you can. It compounds every month.

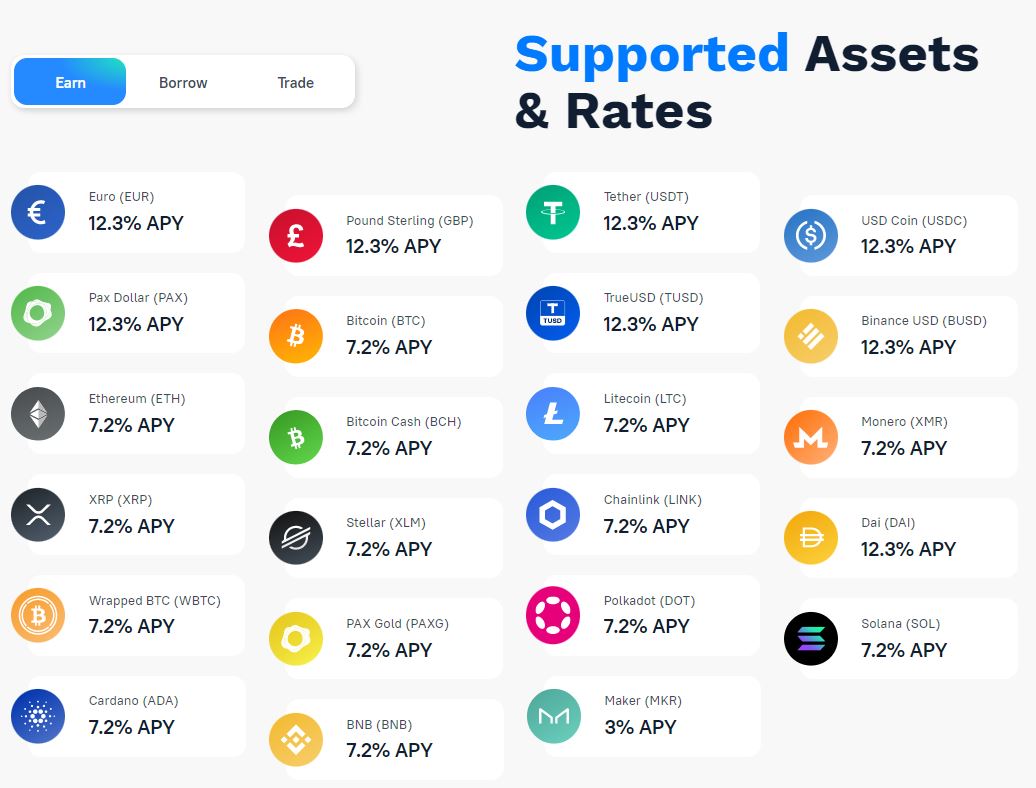

Which currencies does Coinloan accept? Is my investment impacted by crypto price fluctuations?

Coinloan accepts some of the most popular currencies including stablecoins, other very popular crypto currencies and fiat currencies EUR, USD and GBP. The impact of crypto price fluctuations depends on the currencies you hold. Crypto price fluctuations also affect on Coinloan as a company.

Here's the full list of currencies Coinloan uses.

Cryptocurrencies

- CoinLoan Token (CLT)

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Wrapped BTC (WBTC)

- Ethereum (ETH)

- Litecoin (LTC)

- Monero (XMR)

- XRP (XRP)

- PAX Gold (PAXG)

- Stellar (XLM)

- Chainlink (LINK)

- Polkadot (DOT)

- Solana (SOL)

- Cardano (ADA)

- BNB (BNB)

- Maker (MKR)

Stablecoins

- USD Coin (USDC)

- Tether (USDT)

- Binance USD (BUSD)

- TrueUSD (TUSD)

- Dai (DAI)

- Pax Dollar (USDP)

Fiat

- Euro (EUR)

- Pound Sterling (GBP)

- US Dollar (USD)

Is Coinloan regulated? Are there audits?

Yes, coinloan is regulated, it has the following licenses:

- Registered as a financial institution in Estonia

- Registered as a Money Services Business (MSB) in the USA.

Does Coinloan have a corporate acount?

Yes it does, I'm using it. You'll need to submit company related documents to register (memorandum, certificate of incorporation, etc.).

What are the tax implications?

I cannot answer this for you, it varies by country, in many countries crypto projects are a grey area. I use my company to invest and declare it as currency exchange profits.

What are the monthly/yearly returns?

It depends on your currency, but it can go as high as 10% per year.

Do I need to own crypto to invest? If yes, what's the minimum deposit?

No, you can buy it through Coinloan. The minimum deposit is 10 EUR.

Updates & Warnings!

- Since the beginning of October 2022 the Yieldnodes team has stated the project has collapsed!

- They only have around 10% of the investor's account values, 90% was lost

- They will bring in new assets to attach them to NFT's and their coins will represent these assets

- The new assets are mainly in the energy sector in Germany and Iran

- The promised return is 5% per quarter

- Investors will have the option to sell their NFT's