Table of Contents

Nexo Review

Free

Nexo is the crypto equivalent of a traditional bank: Customers can create wallets, get debit cards, exchange currencies, earn interest and get loans. The loans are collateralized by crypto and if your coin depreciates you'll get margin calls, transfers from your savings or automatic repayments from the collateral. Each coin has a different LTV (Loan to Value), for stablecoins this goes up to 90%, for other coins this can go as low as 15%. Through their wallet you can earn up to 12% on stablecoins and fiat.

Pros

- High profitability (around 10% / year)

- Transparant business model

- Regulated financial institution (in many countries)

- Highly rated/reviewed

- Very responsive customer support

- Easy to set up

- High flexibility: Most coins accepted and high flexibility

Cons

- Dependent on crypto market conditions

- Rumored to have financial difficulties

Key Features

- Yearly return of up to 12% on stablecoins and fiat

- Auto-compounding, with daily returns payouts

- Nexo credit card has cashback in crypto, no fx charges on purchases and 10 free ATM withdrawals per month.

- Deposits can be made in fiat or crypto

- Withdrawals can be made via crypto, IBAN or Swift (minimum 10 USD)

- Affiliate rewards: $25 USD in referrals

What is Nexo and how does it work?

How does Nexo make money?

Nexo makes money the same way traditional banks do. They get people to deposit on the platform and they use those deposits to give out loans. Just like a savings account people can earn interest on the funds on their wallet.

Most of Nexo's revenue would therefore come from the interest they charge on loans and exchange charges.

What does Nexo not do?

- It is not trading, it is therefore susceptible to coin price fluctuations.

- It is not Mining (Proof of Work) which requires complex calculations and consumes a lot of energy.

Is Nexo safe?

I believe nothing in the cryptocurrency world is truly safe. The market is much more volatile than the housing, bonds or stock market. However, I believe Nexo's business model is quite low risk because of the following reasons:

- If someone cannot repay their loan they can simply liquidate their collateral.

- If a cryptocurrency loses too much of its value loans will liquidate.

- The LTV values vary depending on the volatility of the coin. The higher the volatility the lower the LTV that is offered. Stablecoins therefore have higher LTV's because they are less volatile.

- If Nexo cannot maintain the interest rates on their interest accounts they can lower them.

What are the risks?

- Liquidity Risk: There is the risk that Nexo doesn't have enough liquidity (cash) to pay its investors/suppliers. This could especially be the case if there is a “bank run”, where depositors are pulling out their funds.

- (Crypto) Currency depreciation: currencies can drop in value, which causes loans to be liquidated. Liquidation would mean that Nexo cannot earn money from that loan anymore.

Profitability (Personal Results included)

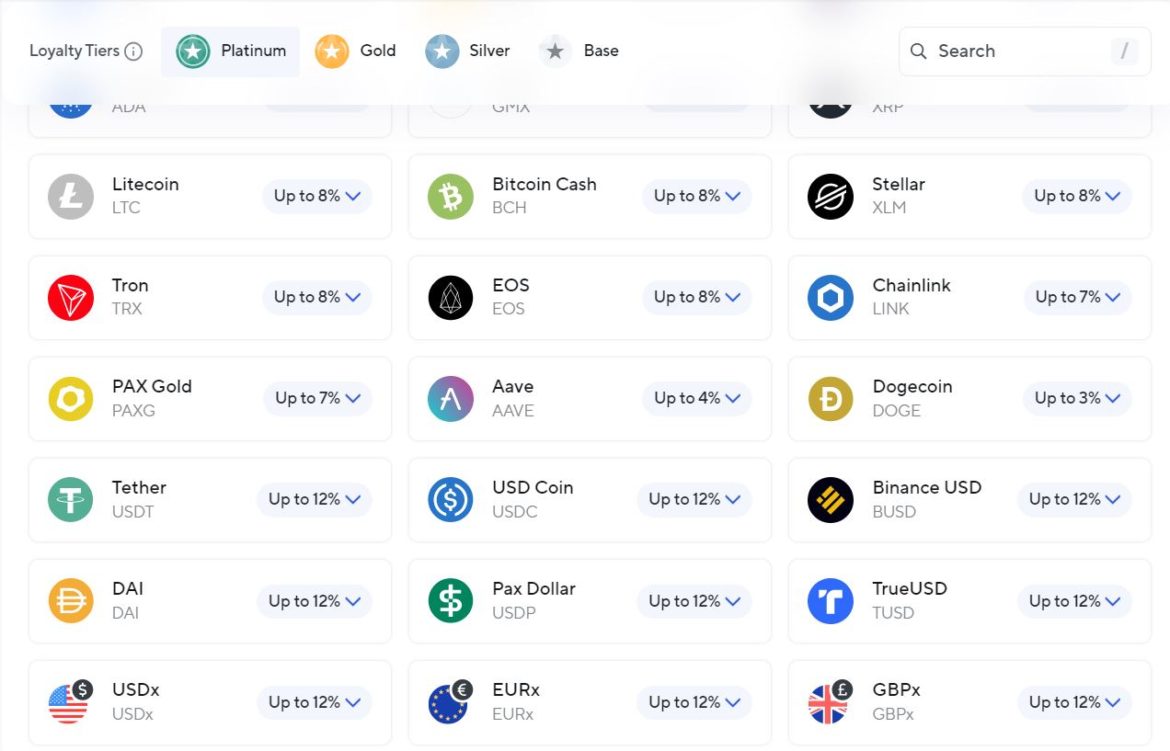

On the Nexo website you'll find a list of all of the returns they offer. You'll see most fiat and stablecoins have returns of 10% or more. Please keep in mind that the percentages shown below include returns based on holding a certain amount of Nexo coins. The returns depend on which loyalty tier you fall under.

To illustrate how the different tiers affect you we can take USDT as an example.

The base tier gives you 8%/year in USDT.

Silver 8.25% in USDT + 0.25% in Nexo.

Gold 9% in USDT + 1% in Nexo.

Platinum gives you 10% in USDT + 2% in Nexo.

These rates are the same for all stablecoins. To reach these rates on Fiat (USDx, EURx, GBPx) you must also lock your funds for 3 months. The tier also determines how many free withdrawals you get in one month. The base tier allows you to get one per month, this increases up to 5 in the platinum tier.

I've had returns of 8% per year (APY), because I fall in the base category. To get the full percentage you need to keep compounding your returns for the entire year.

Note: APY includes the compounding effect, APR does not.

In the below screenshot you can see my 501 USDT balanc, my tier and my return option. Earn in kind means I get my returns in USDT rather than Nexo Token. If I changed this settings I could earn 2% more. You can also see the interest breakdown per currency.

How do the payouts happen?

The earning are allocated to your accounts on a daily basis. There generally isn't any lock period, so you could withdraw those earnings at any time.

Final thoughts

Nexo is an interesting, stable, unique investment. I hope the organization is strong enough to survive difficult times in the crypto market. One of the strongest selling points is that it has many financial licenses and undergoes audits.

FAQ

How do you use Nexo?

I use Coinloan as part of a diversified strategy (aside stocks, ETFs, staking and real estate). I auto-compound because this maximises my returns. I'm only investing in stablecoins at this time.

Do you stake NEXO (Nexo's coin)?

I don't stake Nexo, because I think the returns are not worth the risk. In the year 2022 the coin's value has dropped +70%. Therefore holding more NEXO coins doesn't seem worth the potential extra 2-4% you can earn. You could potentially increase your Nexo holdings if you believe a crypto bull run is coming.

Do I need any technical skills to use Nexo?

No, you do not need any technical skills. I do recommend having an exchange account or a wallet. If don't have a crypto exchange (e.g. Binance), don't worry they are easy to set up. I recommend transferring using USDT (or USDC) because it's a stablecoin and the value is linked to USD. This eliminates any exchange risks.

Can I access my money at any time? How about my initial deposit?

Yes, you can withdraw your funds at any time. Some currencies might require you to lock your funds for some time to get the most return.

Please be aware that your amount of free withdrawals depends on your tier and therefore how many NEXO tokens you hold.

Who can sign up with Nexo?

I believe Nexo accepts most countries, you'll need to be able to withdraw/deposit though.

Can I lose money? What is the risk?

There are a few ways you can lose money:

- The coin you hold loses its value

- Nexo goes bankrupt. This risk is reduced by the regular audits it has with Armanino which requires Nexo to hold sufficient reserves. Reports can be checked on a regular basis.

- Nexo gets hacked, although it has insurance from Lloyds (+$100m) to cover this risk. It also uses Bitgo wallets and has 2FA, whitelisting and other methods to secure your account.

Are there any fees/costs?

No, you'll never need to pay anything.

Can I compound my returns?

Yes you can. It compounds daily.

Which currencies does Nexo accept? Is my investment impacted by crypto price fluctuations?

Coinloan accepts some of the most popular currencies including stablecoins, other very popular crypto currencies and fiat currencies EUR, USD and GBP. The impact of crypto price fluctuations depends on the currencies you hold. Crypto price fluctuations also affect on Nexo as a company.

Here's the full list of currencies Nexo uses.

Crypto:

BTC, ETH, NEXO, XRP, USDT, USDC, USDP, TUSD, BUSD, DAI, BCH, LTC, EOS, BNB, XLM, PAXG, LINK, TRX, ADA, DOT, DOGE, UNI, AXS, MATIC, GALA, SUSHI, CRV, AAVE, APE, 1INCH, MKR, MANA, SAND, FTT, HT, LDO, ENS, SWEAT, GRT, COMP, GMT, SNX, CHZ, CVX, FXS, DYDX, APT, BAL, KNC, BAT, ENJ, YFI

Fiat

- Euro (EUR)

- Pound Sterling (GBP)

- US Dollar (USD)

Are the yields sustainable?

As long as Nexo can attract sufficient borrowers and depositors I believe they can be maintained.

Does Nexo have a corporate acount?

Yes it does, I'm using it. You'll need to submit company related documents to register (memorandum, certificate of incorporation, etc.).

What are the tax implications?

I cannot answer this for you, it varies by country, in many countries crypto projects are a grey area. I use my company to invest and declare it as currency exchange profits.

What are the monthly/yearly returns?

It depends on your currency, but it can go as high as 12% per year.

Do I need to own crypto to invest? If yes, what's the minimum deposit?

No, you can buy it through Nexo. The minimum is not stated on their website but I assume it is very low such as 10 USD.

Platinum: more than 10% of your portfolio is in

Platinum: more than 10% of your portfolio is in  Gold: 5% to 10% of your portfolio is in

Gold: 5% to 10% of your portfolio is in  Silver: 1% to 5% of your portfolio is in

Silver: 1% to 5% of your portfolio is in  Base: less than 1% of your portfolio is in

Base: less than 1% of your portfolio is in