Table of Contents

Coinloan Review

Free

Haru Invest makes gets returns in the following ways: Arbitrage trading, Spread trading and market neutral strategies. All of those are typically low risk. You can lock up your funds for as long as you like. Earn plus gets you up to 14% per year, Earn Explore up to 25%. The minimum lock period is 15 days for Earn Plus and 1 month for Earn Explore.

Pros

- High profitability (7 - 25% / year)

- Transparant team and business model

- Highly rated/reviewed

- Very responsive customer support

- Easy to set up

- High flexibility: Main coins accepted and high flexibility

Cons

- Currently unregulated, although they are applying for licenses in S. Korea

- Freeze product is not very clear

Key Features

- Yearly return of up to 15% for Earn Plus and up to 25%on Earn Explore.

- You can invest in USDT, USDC, Bitcoin (BTC), Ethereum (ETH) and Rippple (XRP)

- Auto-compounding

- Minimum 1 USD for deposits and 20 USD for withdrawing

- Withdrawals can only be made in crypto, through the relevant networks. ERC20 in the case of USDT & USDC

- The minimum lock period is 15 days for Earn Plus and 1 month for Earn Explore.

- Referral program

What is Haru Invest and how does it work?

Haru invest uses your funds to do arbitrage and spread trading. In return you either get a fixed percentage through Earn Plus or a variable percentage through Earn Explore.

How does Haru Invest make money?

Haru Invest makes money the same way some banks do. They get people to deposit on the platform and they use those deposits to reinvest or trade. Just like a savings account people can earn interest on their interest account.

What does Haru Invest not do?

- It is not traditional trading, they limit themselves to arbitrage, spread and market neutral strategies.

- It is not Mining (Proof of Work) which requires complex calculations and consumes a lot of energy.

Is Haru Invest safe?

I believe nothing in the cryptocurrency world is truly safe. The market is much more volatile than the housing, bonds or stock market. However, I believe Haru's business model is quite low risk because of the following reasons:

- Arbitrage and spread trading are safer, they make use of market and exchange inefficiencies.

- They have quite a good reputation.

What are the risks?

- Liquidity Risk: There is the risk that Haru Invest doesn't have enough liquidity (cash) to pay its investors/suppliers. This could especially be the case if there is a “bank run”, where depositors are pulling out their funds. I believe this risk is quite limited because the traded funds can simply be reduced.

- (Crypto) Currency depreciation: If you hold funds at Haru in Bitcoin or Ethereum, these values can drop, which negatively affects your returns. A collapse of a stablecoin could have the same effect.

Profitability (Personal Results included)

On the Haru Invest website you'll find a list of all of the returns they offer. You'll see most Coins have returns of 10% or more.

The holding of CLT increases your returns as followed.

Earn Explore (BTC, ETH, USDT)

Locked for 1-3 months

Payout Frequency: Bi-weekly

Return: up to 25% per year

Earn plus (BTC, ETH, USDT, USDC, XRP)

Customized between 15 to 365 days

Payout Frequency: Daily

Return: up to 14% per year

I've had returns of 10% per year (APY) so far. To get the full percentage you need to keep compounding your returns for the entire year.

Note: APY includes the compounding effect, APR does not.

How do the payouts happen?

On Earn Explore they get added to your balance bi-weekly, on Earn Plus they get added every day.

Final thoughts

Haru Invest is an interesting, stable, unique investment. I hope the organization is strong enough to survive difficult times in the crypto market. However, this might create opportunities for Haru invest to generate returns.

FAQ

How do you use Haru Invest?

I use Haru Invest as part of a diversified strategy (aside stocks, ETFs, staking, real estate, etc.). I auto-renewal because this maximises my returns. I use a mix of Earn Plus and Earn Explore and only hold stablecoins.

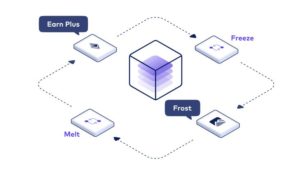

What are Haru's products? Can I earn on Haru's wallet?

- Earn up to 6% APR

- Deposit & withdraw anytime

- No lock-up required

- Daily compound earnings

- Earnings paid out daily

Haru Earn Plus

Lock-up for a period of your choosing (15-365 days), the longer you lock the more you earn. The strategies are quite risk averse.

Haru Earn Explore

- Earn explore uses a strategy designed by professionals with no management fee. There is no fee unless earnings exceed 15% APR.

- Earnings are released twice per month, every 15th and end of the month.

- You can lock for a period of your choosing, but it needs to be at least one month.

- There is no guarantee of return of your principal.

Switch

This product allows you to exchange cryptos and become a liquidity provider and farm.

Freeze

You can sell your Earn Plus subscriptions by freezing them and selling them as frost, then they become collectibles and become tradable. They are not NFTs at the moment. Crystals are a collection of frosts.

Do I need any technical skills to use Coinloan?

No, you do not need any technical skills. You do need an exchange account or wallet. If don't have a crypto exchange account (e.g. Binance), don't worry they are easy to set up. I recommend transferring using USDT (or USDC) because it's a stablecoin and the value is linked to USD. This eliminates any exchange risks.

Can I access my money at any time? How about my initial deposit?

yes, you can although Haru Invest requires you to lock your funds for the period of your choosing. You also earn money on simply holding the funds in your wallet, but this is significantly less.

You cannot withdraw your funds while they are locked into any product.

Who can sign up with Haru?

I believe Haru accepts most countries, you'll need to be able to withdraw/deposit though.

Can I lose money? What is the risk?

There are a few ways you can lose money:

- The coin you hold loses its value

- Haru Invest goes bankrupt

- Haru Invest gets hacked, although it has insurance from Lloyds to cover this risk

- Haru's strategies lose money.

Are there any fees/costs?

No, you'll never need to pay anything.

Can I compound my returns?

Yes you can, especially if you renew your subscription.

Which currencies does Coinloan accept? Is my investment impacted by crypto price fluctuations?

Coinloan accepts some of the most popular currencies including stablecoins, other very popular crypto currencies The impact of crypto price fluctuations depends on the currencies you hold. Haru invest depends on price differences for its profitability, so while volatility poses risks it also creates opportunities.

Here's the full list of currencies Coinloan uses.

Cryptocurrencies

- Bitcoin (BTC)

- Ethereum (ETH)

- XRP (XRP)

Stablecoins

- USD Coin (USDC)

- Tether (USDT)

Are the yields sustainable?

As long as Haru Invest's strategies work I believe the yields can be maintained. Although realistically I believe they will decrease when more people use them and market inefficiencies reduce.

Haru can adjust the rates at any time.

Is Haru Invest regulated? Are there audits?

Currently Haru Invest is only registered as a Money Services Business (MSB) in the USA. Haru is also applying for licenses in Korea.

Does Haru have a corporate acount?

Yes it does, I'm using it. You'll need to submit company related documents to register (memorandum, certificate of incorporation, etc.).

What are the tax implications?

I cannot answer this for you, it varies by country, in many countries crypto projects are a grey area. I use my company to invest and declare it as currency exchange profits.

What are the monthly/yearly returns?

It depends on your currency, but it can go as high as 10% per year.

Do I need to own crypto to invest? If yes, what's the minimum?

Yes, you do own crypto and transfer it to Haru. The minimum deposits are as followed:

BTC: 0.0001 BTC

ETH: 0.005 ETH

USDT: 1 USDT

USDC: 1 USDC

XRP: 10 XRP